Invesment Proposal- Premium Resort Development on Jaipur-Delhi Highway Near Hills

- :

1. Location & Surroundings

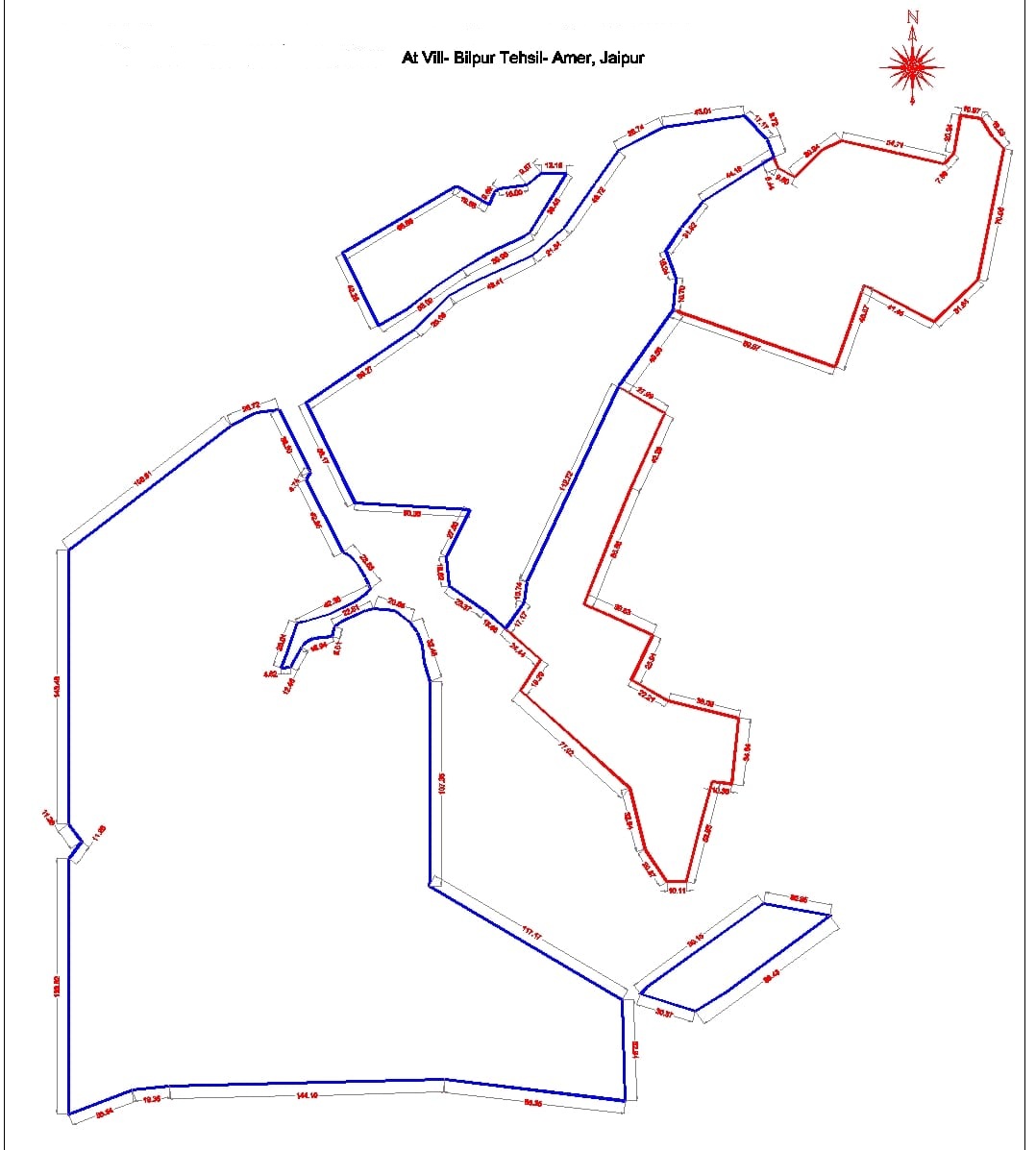

(Village Bilpur, Tehsil Amer, on main Jaipur-Delhi Highway).

– Land parcel: ~26-30 Bigha (3025 sq yards per Bigha)depth, adjoining natural hill slopes.

– Surrounded by: Hotels/Resort HUB Conservation Area, natural hills, forest views and upcoming eco-luxury resorts.

– Connectivity: ~35–45 minutes from Jaipur Airport & City, direct approach via Jaipur–Delhi Highway.

2. Concept: Premium Eco-Resort Villas

Independent Villa Resort model with low-density luxury villas + eco-tourism retreat, respecting natural terrain.

– Phase 1: 60 villas (Standard, Premium, Pool Villas) + clubhouse, spa, banquet lawns.

– Phase 2: Expansion to 120–150 villas with adventure & wellness zone.

3. Product Mix

– Standard Villas: 500–600 sq.ft. | Couples, small families.

– Premium Villas: 750–850 sq.ft. | Destination weddings, long-stay guests.

– Pool Villas: 1,000+ sq.ft. | Ultra-luxury weekend homes & foreign tourists.

Facilities: Spa, yoga deck, infinity pool, banquet (500–800 pax), organic café, kids’ & adventure zones.

4. Market Opportunity

Jawai–Lapord Hills is an emerging wildlife + wedding + wellness hub.

Rising demand for villa-style resorts in Rajasthan

Target Segments:

– Luxury domestic tourists (Jaipur, Delhi NCR, Gujarat, Metro city).

– Destination weddings & MICE.

– International eco-luxury travelers.

– Villa investors (lease-back model).

5. Financial Snapshot (Indicative)

– CapEx: ₹175–225 Cr (depending on phasing).

– ADR (Average Daily Rate): ₹10,000–18,000.

– Occupancy: 55–65%.

– Revenue Mix: Rooms (50%), F&B (20%), Weddings/MICE (30%).

– Villa sales: ₹1.5–2.5 Cr each (lease-back option).

– Stabilized Revenue: ₹70–90 Cr/yr.

– EBITDA: ₹20–30 Cr/yr (28–32% margin).

– IRR: ~18–22%.

6. Investment Opportunity

– Equity JV / Co-development model with landowners & investors.

– Investor Options:

• Equity participation.

• Villa pre-sales (with guaranteed returns).

• REIT / hospitality fund exit.

– Phased capital recovery through villa pre-sales (~₹80–100 Cr in Phase 1).

7. Strategic Advantage

– Prime Location: Leopard sanctuary & hill backdrop.

– Unique Product: Premium villa resort, first-mover advantage.

– Dual Revenue: Villa sales + resort operations.

– Sustainability: Eco-friendly, zero-waste design, local community employment.

Next Steps

– Zoning approval.

– Masterplan design with eco-architects.

– Pre-sales campaign & investor engagement.